A blog that covers Politics, finance, economics, and science. Perspective is conservative in the non-social sense, but not dogmatically so. Maintained by the Chief Technology Officer of a large Hedge Fund

Saturday, July 30, 2011

Tweet from @jtLOL

Friday, July 29, 2011

President Obama Is No Longer Tethered To Reality

Obama, Geithner May Regret Threats of Default: Caroline Baum

manageable in relation to the size of the economy.

Libya's rebels...

Units loyal to Gen Abdel Fattah Younes, who was shot dead on Thursday, reportedly abandoned the rebel front line near the oil town of Brega and poured into the opposition capital of Benghazi to avenge their commander's death.

The U.S. homeownership rate...

foreclosures forced people out of their residences. The ownership rate through June was 65.9 percent, the lowest since the same rate 13 years ago, the U.S. Census Bureau said in a report today. The vacancy rate, the share of properties empty and for sale, was 2.5 percent, compared with 2.6 percent in the first quarter.

House Minority Leader Nancy Pelosi (D-Calif.) said that House Republicans should not be connecting an increase to the debt limit to reducing the nation's current $1.5 trillion deficit. "Over 30 times we have lifted the debt ceiling since President Reagan was president.

Over 30 times, not one time did we subject a president to this burden of

saying you can't - we won't lift it unless we reduce the deficit," said

Pelosi

-->

http://cnsnews.com/news/article/pelosi-gop-connecting-debt-limit-reducin

Obama: Why Isn’t Anyone Thinking About My Reelection?

This is a patently ridiculous statement on its face; the debt ceiling has to be raised regularly–as Obama has frequently reminded the American people during this debate. Does that mean "the problem" is never solved? If so, the GOP has nothing to do with it. Is Obama pushing for the elimination of the debt ceiling? No, what he meant to say was: "In other words, it does not solve my problem."

---> http://www.commentarymagazine.com/2011/07/29/obama-reelection/

Goldman Sachs and Citigroup...

Primary Dealers called to NY Fed...

week.

Consensus forecast...

The 6 month average is currently +126K

GDP

This and the sharp revisions to previous quarters suggest a more troubling and fundamental slowdown may be underway

Thursday, July 28, 2011

Both the FT and WSJ carry stories...

...that IMF officials (particularly those from Emerging Markets) are unconvinced on the latest Greek bail out package and nervous about committing more funds. The assumption was that the IMF would provide €36bn of the €109bn - maybe the EFSF will have to carry more, further reducing its potential firepower

Obama 'Unpresidential,' 'Petulant' 'Dividing Us': Langone

President Obama's conduct during the debate over the debt ceiling has divided the country and will inflict damage that will last well after the battle is over, former New York Stock Exchange director Ken Langone said.

Full Story:

http://www.cnbc.com/id/43924372

US Downgrade Good for Dollar? Don't Rule It Out

When "the dollar is the reserve currency underpinning the system, waking up to discover that U.S. debt may not be AAA after all is surely a market event," says an analyst at one European bank.

Full Story:

http://www.cnbc.com/id/43922241

Wednesday, July 27, 2011

Mohamed A. El-Erian’s latest article...

http://bit.ly/or725g

Tweet from @jestei

The CBO...

Boehner's office...

Aren't we overdue...

Obama, FDR, and the Strategy of Massive Spending

Sent to you by wam4 via Google Reader:

"FDR comes in, he tries all these things with the New Deal; but FDR, contrary to myth, was pretty fiscally conservative." Thus spoke President Obama at a town-hall meeting at the University of Maryland. The president likes FDR and believes the two of them think in similar ways. That may be true, but the major myths we need to correct are those put forth by President Obama on the success — or lack thereof — of FDR's economic policies. Let's look at three myths about FDR that Obama supported in his town-hall speech.

First, FDR was "pretty fiscally conservative." False. No president before FDR ever grew the national debt more rapidly in peacetime. In fact, FDR increased the national debt by more in his first two terms than 30 presidents combined did before him, more than doubling it. And in April 1939, toward the end of his second term, unemployment was 20.7 percent — greater than it had ever been before the Great Depression. All that massive spending and almost no jobs created with those tax dollars.

Keep reading this post . . .

Things you can do from here:

- Subscribe to The Corner using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Rule by Rating Agencies

Sent to you by wam4 via Google Reader:

This, from Holman Jenkins, sounds right to me:

For the unwarranted power granted to rating agencies, which after all merely issue opinions, blame U.S. law and regulation. These require bankers, pension funds and other regulated investment funds not just to consult ratings, but to act on them.

Keep reading this post . . .

Things you can do from here:

- Subscribe to The Corner using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Growth Slowed in 8 of 12 U.S. Regions: Fed

"However, the pace has moderated in many districts." Growth

slowed in eight of the Fed's 12 regions, compared with four in the last survey, the central bank said. The report underscores Fed Chairman Ben S. Bernanke's message to Congress earlier this month that maintaining record monetary stimulus is necessary to bolster the economy

-->

Some Facts About the Debt Limit

Sent to you by wam4 via Google Reader:

This chart by the Heritage Foundation offers a great deal of information about the history of changes in the debt limit–which, of course, tracks closely with the history of growing federal debt. You can see at a glance how the skyrocketing debt of the last few years smashes all historical precedent:

The chart also responds implicitly to some recent Democratic Party talking points. The Democrats like to point out that the ceiling was raised 18 times during the Reagan administration. That's right, an average of about once every six months. In other words, those increases were small and highly temporary, as you can see from the chart. It is also noteworthy that the total increase in the debt ceiling during the Reagan years was almost exactly equal to the increase in the debt ceiling during the Clinton administration. Neither, however, is in the same universe with the spiraling debt the Democrats have racked up since they took control of Congress in 2007.

Things you can do from here:

- Subscribe to Power Line using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

No growth, no jobs

Sent to you by wam4 via Google Reader:

I AM prepared to accept that the American economy faces some, and perhaps many, structural labour market problems. It would be strange if there were no structural issues slowing employment growth, and it would be stranger still if a sustained period of very high long-term unemployment didn't add to these problems. But if you're looking to explain the painfully slow recovery in labour markets, you don't need to focus on these structural problems. All you really need to look at is the path of GDP growth.

The recession was an ugly one, at least relative to postwar American recessions. Real output grew just 1.9% in 2007, was flat in 2008, and fell 2.6% in 2009. That performance was more than enough to create a large pool of unemployed workers. The American economy is estimated to have a trend growth rate between 2% and 3%. To reabsorb idled workers while also accommodating normal labour force growth, the economy needs to grow above that trend rate. In 2010 it barely managed this, growing at 2.9% for the year as a whole. In the first quarter of 2011, growth slowed to just 1.9%—below trend. We have yet to get official numbers on the second quarter, but it's a good bet that the expansion performed below trend once again. Goldman Sachs estimates the annual growth rate in the second quarter at just 1.5%. Macroeconomic Advisers puts it at 1.4%.

At best, closure of America's output gap seems to have stalled. And unsurprisingly, the labour market has failed to add enough jobs over the past couple of months to keep up with normal labour force growth. Meanwhile, early forecasts for third quarter output growth are being revised down. That seems premature to me; the third quarter has only just begun and it still seems likely that low petrol prices and a recovering Japan, among other things, may buoy American output. But the broader point is this: two years into recovery, GDP has simply not recovered fast enough to put unemployed Americans back to work, and it isn't clear that a sustained acceleration is on the way.

The question then becomes why growth has been so slow. I'll address that in a follow-up post.

Things you can do from here:

- Subscribe to Free exchange using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Worried About a Downgrade?

Sent to you by wam4 via Google Reader:

According to Politico, today the risk of a downgrade by S&P is what's scaring the White House and Congress the most, not default.

It's not the default that strikes the most fear in the White House and Congress these days. It's the downgrade.

Keep reading this post . . .

Things you can do from here:

- Subscribe to The Corner using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Ten things that happen if the Boehner bill gets through

Sent to you by wam4 via Google Reader:

We know what happens if the Boehner bill fails in the House. There is no alternative plan. We suffer whatever shock to the U.S. and world economies that will follow a default. The president will go to the country, claiming the Republicans endangered the country's economy and global standing. But what happens if the House passes the Boehner bill?

1. The Boehner bill becomes the inevitable solution to the crisis. As Keith Hennessey explains, we also make progress in restoring fiscal sanity:

2. The House would have done its job without violating the core promises the speaker made: more spending cuts than dollars increased in the debt ceiling. And no tax hikes.

Read full article >>Things you can do from here:

- Subscribe to Right Turn using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Reports: House GOP lining up behind Boehner’s plan

Sent to you by wam4 via Google Reader:

"[T]his may not even be close."

They're getting their asses in line. [T]he opposition bloc led by [Jim] Jordan appears to be crumbling, as leadership's message seems to be sinking in. Sources tells NRO that a number of members who were confirmed no votes against the Boehner plan announced during the meeting that they would be voting yes. One of those [...]

Things you can do from here:

- Subscribe to Hot Air » Top Picks using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

US Durable Goods ex-Transportation...

Treasury bonds...

Weekly Standard Editor Bill Kristol..

US government social welfare benefits...

Broad mortgage application index...

Tuesday, July 26, 2011

More Americans unhappy with Obama on economy, jobs

More Americans unhappy with Obama on economy, jobs

Monday, July 25, 2011

Tweet from @JRubinBlogger

Tweet from @stephenfhayes

Tweet from @stephenfhayes

Tweet from @jimgeraghty

Tweet from @jaketapper

President's last major speech...

Atlantic contagion

Sent to you by wam4 via Google Reader:

SORRY to be so stuck on news in Europe and America; these days it's difficult to focus on much else. Earlier today, I mentioned that yields on Spanish and Italian debt were up sharply to start the week. That increase is partially a product of ongoing consideration of last week's deal and it's implications for the future of the euro zone. It was also influenced by a Moody's downgrade of Greek debt. The ratings agency expressed concern that a Greek default would hit financial institutions in other peripheral countries, and it fretted that, "The support package sets a precedent for future restructurings should the finances of another euro area sovereign become as problematic as those of Greece". In other words, having put together the machinery of a sovereign-debt restructuring, the euro zone is likely to use it more than once. That doesn't mean that the euro zone made a mistake in putting these mechanisms together; it was simply acknowledging the inevitable. But having acknowledged one obvious case of insolvency, it does become harder to delay acknowledgement of other obvious cases.

That's especially true when pressure is being applied from several directions. The Financial Times reports today that a number of European banks with significant exposures to Greece are showing reluctance to sign up for one of the voluntary restructuring options in last week's deal. It's early going yet, but there is growing concern that the estimated 90% take-up of the restructuring offerings was a tad optimistic.

European banks have plenty to worry about, as things stand. European default risk is one worry, but banks are also feeling an impact from the impasse in America. The FT:

US money market funds have sharply cut their exposure to banks in the eurozone over the past few weeks and reduced the availability of credit, even in stronger countries such as France.

While the agreement of a second bail-out deal for Greece might ease nerves, the funds are also stockpiling cash in case US politicians fail to raise the federal debt ceiling, prompting withdrawals from investors.

One French financier said: "Up to mid-June, getting three, six or nine-month money was not that difficult.

"But now, getting one-week or one-month money is about all we can manage".

At the moment, this is undermining euro-zone economic activity and putting additional pressure on stress banks. Should a debt-ceiling impasse lead to real financial market difficulties and a flight to safety, peripheral banks and sovereigns will come under a great deal of pressure. A lot of people will yank their money away from anything that looks vulnerable, and there are a lot of European institutions looking vulnerable right now.

America will probably avoid the catastrophe of an outright default. But it could experience an economic setback serious enough to trigger collapse in Europe. If you think those two dominoes can fall without knocking over any others, you're more optimistic than I am.

Things you can do from here:

- Subscribe to Free exchange using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Geithner Admits to Playing Politics with Debt Ceiling

Sent to you by wam4 via Google Reader:

Why, exactly, do we need to extend the debt limit to the point where the federal government can borrow another $2.4 trillion (hardly a nice round number) — about the same amount of money, even in inflation-adjusted dollars, that we borrowed to fight all of World War II? Because, as Treasury Secretary Timothy Geithner made abundantly clear during his Fox News Sunday interview with Chris Wallace, $2.4 trillion is the amount of money that the Obama administration thinks it needs to borrow (on behalf of taxpayers, who will have to pay it back) to get Obama through the next election.

Here is Secretary Geithner, during his interview:

"Chris, let me tell you what we're trying to do, what the president is trying to do, is, first and most important, we have to lift this threat of default from the economy for, you know, for the next 18 months. We have to take that threat off the table through the election…."

Geithner then proceeded twice more to reiterate the importance of the 18-month timeline forgetting through the election.

How's that for taking the long-term view?

Two other points are worth noting from the interview. The Treasury secretary blamed this year's slow rate of economic growth partly on "a lot of bad weather" — and also on the fact that "oil prices went up." Of course, Americans wouldn't be as vulnerable in the long-term to rising oil prices if the Obama administration weren't so adamantly opposed to domestic exploration.

In the course of the interview, Wallace also observed that "Republicans have offered several specific plans to deal with the national debt," noting, "They have the Ryan plan. They had cap, cut and balance. You guys have no plan…."

Geithner replied that Obama has "a framework." Wallace responded, "…which the CBO director said is so fuzzy, he couldn't even score it." Geithner then repeated the principal Democratic talking point against Ryan's bold and responsible plan to reform Medicare — that it would allegedly, in Geithner's words, "require beneficiaries of Medicare to pay $6,500 a year more…for Medicare benefits than they do today."

That claim, however, contradicts 40 years of empirical evidence about whether the government or the private sector does a better job of controlling health costs. It also obscures the fact that the Ryan plan wouldn't affect anyone who's currently at least 55 years of age. In fact, Ryan's Medicare reforms wouldn't even go into effect for more than a decade (in 2022) — a lot more than 18 months from now.

Things you can do from here:

- Subscribe to The Weekly Standard Blog using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Jobs Woes Make U.S. Labor Market Look More European

Sent to you by wam4 via Google Reader:

The financial crisis has helped to wash away a defining difference between U.S. and European labor markets, economists at the Federal Reserve Bank of New York said Monday.

In a posting on the bank's website, the analysts note that over the last decade, the percentage of workers relative to overall population has moved closely together in the two economic blocs, largely because of lost ground in America. The convergence has several drivers.

"The narrowing employment gap is due to three factors: declining U.S. employment rates across almost all age-gender groups; more women working in Europe, particularly prime-age and older workers; and rising employment for older European men," wrote Christian Grisse, Thomas Klitgaard and Aysegul Sahin, for the New York Fed's Liberty Street Economics blog.

The researchers observed that a decade ago, the labor participation gap was 10.5%, with the U.S. putting the greater share of its population to work. This disparity was largely attributed to American firms' greater ease in hiring and firing staffers. Meanwhile, the argument has gone that Europe's more generous social safety net and labor protection laws have made it easier not to work, and complicated firms ability to hire in the face of always uncertain business conditions.

As of 2009, the researchers said the gap between labor participation rates in the U.S. and Europe has moved to a relatively modest 1.7%. The difference had already fallen to just under 5% on the eve of the financial crisis.

The New York Fed report arrives at a time when U.S. labor conditions remain under considerable pressure. Even with a recovering economy, the nation seems unable to add jobs in a significant fashion, and while it's off its peak, the unemployment rate stood at 9.2% last month. In years past that sort of unemployment level was not unfamiliar in Europe even during times of economic health, and it is shocking to most observers to see it now in the U.S. economy. What's more, most forecasters agree it will be a long time before U.S. unemployment falls back toward its historical norm, so the difficulty of finding jobs may keep the labor participation rate depressed as well.

Relatively speaking, European labor markets lost less ground during the financial crisis. The report says some of that success comes from European attempts to make their labor markets more flexible.

The economists see some ground for U.S. labor participation rates to rise above Europe's again, but they reckon what was seen in the past is unlikely to be repeated.

"The increase in Europe's employment rate, particularly for women and older workers, represents a steady change over the past decade as the rate neared the U.S. rate," the economists wrote, adding, "the influence of this development on the narrowing of the employment gap is unlikely to be substantially reversed."

Things you can do from here:

- Subscribe to Real Time Economics using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Obama's Empty Dance Floor

Sent to you by wam4 via Google Reader:

President Obama, at a speech earlier today at the National Council of La Raza, indicated that he "need[s] a dance partner here -- and the floor is empty."

THE PRESIDENT: ... Now, I know some people want me to bypass Congress and change the laws on my own. (Applause.) And believe me, right now dealing with Congress –

AUDIENCE: Yes, you can! Yes, you can! Yes, you can! Yes, you can! Yes, you can!

THE PRESIDENT: Believe me -- believe me, the idea of doing things on my own is very tempting. (Laughter.) I promise you. Not just on immigration reform. (Laughter.) But that's not how -- that's not how our system works.

AUDIENCE MEMBER: Change it!

THE PRESIDENT: That's not how our democracy functions. That's not how our Constitution is written. So let's be honest. I need a dance partner here -- and the floor is empty. (Laughter.)

The president seems to be suggesting that Republicans don't want to come to the table to broker a deal on the debt ceiling and that he's all by himself--the sole honest broker in all of the negotiations. But the Republicans have actually passed a plan in Congress, and Obama refuses to walk away from the idea that tax hikes are what is now required to solve our economic woes.

But maybe it is pretty lonely for the president on that dance floor, considering the Democrats don't seem willing to dance with him. The AP reports:

Senate Majority Leader Harry Reid, D-Nev., has been working on a fallback bill that officials said would cut $2.7 trillion in federal spending and raise the debt limit by $2.4 trillion in one step - enough borrowing authority to meet Obama's bottom-line demand.

In the process, though, another of the president's long-held conditions appeared to be in danger of rejection.

Neither Boehner's measure nor the one Reid was drafting included additional revenue, according to officials in both parties.

So Senate majority leader Harry Reid is brokering his own plan with Speaker of the House John Boehner. And where's the president? Delivering a speech to La Raza.

The other revealing thing President Obama said is this: "Believe me -- believe me, the idea of doing things on my own is very tempting." No doubt it is.

The statement is reminiscent of Obama's reaction to the Egyptian protests in Tahrir Square. "Mr. Obama has told people that it would be so much easier to be the president of China. As one official put it, 'No one is scrutinizing Hu Jintao's words in Tahrir Square,'" the New York Times reported in March.

Of course it's a hard job to be president of the United States. And of course it's hard to broker a deal with folks who don't believe in your political philosophy. But there isn't much gained by complaining about the system he ran to be the leader of.

Things you can do from here:

- Subscribe to The Weekly Standard Blog using Google Reader

- Get started using Google Reader to easily keep up with all your favorite sites

Obama to Banks: We're Not Defaulting

the weekend about the possibility of a debt default if the debt ceiling isn't raised, they privately have been telling top executives at major U.S. banks that such an event won't happen, FOX Business has learned.

In a series of phone calls, administration officials have told bankers that the administration will not allow a default to happen even if the debt cap isn't raised by the August 2 date Treasury Secretary Tim Geithner

says the government will run out of money to pay all its bills

Article-->

http://www.foxbusiness.com/markets/2011/07/25/obama-to-banks-were-not-defaulting/

Still no sign of panic in markets

Despite the media hype about a major sell-off in markets Monday without a debt ceiling deal, investors seem to be mostly shrugging off the weekend's news about the ongoing stalemate. While stocks are down, they aren't down by much.

The Dow is off 33 points, or about 0.5 percent in mid-morning trading. The S&P 500 and Nasdaq averages are roughly similar.

"There's nervousness about the U.S. debt negotiations, but this isn't panic in the markets," one investor told Bloomberg. This isn't to say that the markets don't care if the debt ceiling is raised.

Article-->

http://washingtonexaminer.com/blogs/beltway-confidential/2011/07/still-no-sign-panic-markets

The release of Oil from the SPR...

Obama administration's charm offensive fails to win over business groups

healthcare and financial regulation laws.

There's also fear that labor-friendly policies emerging from the National Labor Relations Board and tax-reform legislation expected in 2012 will further hold back growth."With the Obama administration, it just seems to be relentless," said David Rhoa, owner of a bulk-mailing facility

Full Story:

http://thehill.com/homenews/administration/173177-charm-offensive-fails-to-win-over-business

White House stokes debt-ceiling crisis

all agreed on the general framework of a two-part plan. A short-term increase (with cuts greater than the increase), combined with a committee to find long-term savings before the rest of the increase would be considered. Sen. Reid took the bipartisan plan to the White

House and the President said no." If this is accurate the president is playing with fire. By halting a bipartisan deal he imperils the country's finances and can rightly be accused of putting partisanship above all else.

Daily US Opening News And Market Re-Cap: July 25

Despite frantic efforts to reach an agreement to raise the US debt ceiling, no concrete measures emerged during the weekend, which allied with Moody's downgrade of Greece's sovereign rating by three notches today, promoted risk-aversion in the market.

European equities traded under pressure, weighed upon by financials, which in turn provided support to Bunds, whereas the Eurozone peripheral 10-year government bond yield spreads widened across the board. Particular widening was observed in the Belgian/German spread leading up to the bond auctions from Belgium, however the spread narrowed somewhat after they went through successfully. Elsewhere, CHF and JPY emerged as major

beneficiaries of the risk-averse trade, whereas commodity-linked currencies traded lower.

Moving into the North American open, the economic calendar remains thin, however Chicago Fed National Activity and Dallas Fed Manufacturing reports are scheduled for later in the session. Also, Texas Instruments, and Anadarko Petroleum are among some of the companies reporting their corporate earnings today.

Gold at record

Gold climbed to a record in New York and London as U.S. lawmakers failed to reach an agreement on raising the federal debt limit, boosting demand for the metal as a protection of wealth.

U.S. House Speaker John Boehner plans to press ahead with a two-step debt-limit extension that President Barack Obama has threatened to veto, fueling concern the nation is lurching toward a default as early as Aug. 2 and jeopardizing its AAA credit rating. Greece's rating was cut three notches by Moody's Investors Service. Europe's debt woes helped bullion reach all- time highs in euros and pounds last week.

Swiss Franc strongest ever

Switzerland's franc strengthened to a record against the dollar on demand for the safest assets as U.S. lawmakers failed to agree on raising the nation's $14.3 trillion debt ceiling and Greece's credit rating was cut.

The franc also appreciated toward a record versus the euro, while the yen rose against 15 of 16 major peers. U.S. Republicans and Democrats prepared dueling plans for raising the debt ceiling, seeking to break a partisan stalemate amid market concern about a potential default Aug. 2. The euro slid against the yen as Moody's Investors Service downgraded Greece to its second-lowest rating, saying the European rescue plan for the debt-laden nation will amount to a default.

Moody's: Greek Default Is Almost Certain. Here's Why

Ratings agency Moody's has cut Greece's debt ratings by three notches to Ca on Monday, leaving it just one notch above what is considered default, and said the chance of a default is now "virtually 100 percent".

Full Story:

http://www.cnbc.com/id/43876647

Sunday, July 24, 2011

Still No Deal, GOP Will Move Own Plan

Keep reading this post . . .

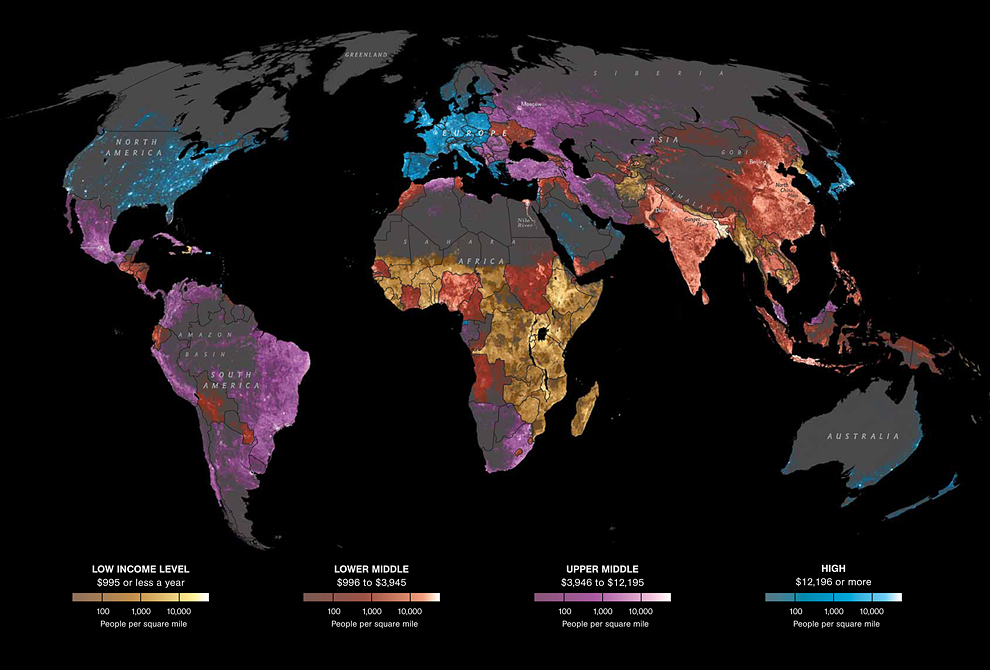

Income Distribution Across the World’s 7Billion

This interactive Nat Geo chart shows the distribution of income around the globe:

>

Click into interactive map for more information

The Demand For Water

The Demand For Water Will Increase Five Times By 2050

http://blogs.forbes.com/robertlenzner/2011/07/23/the-demand-for-water-will-increase-five-times-by-2050/

Saturday, July 23, 2011

Barack Obama's approach to the deficit

Barack Obama's approach to the budget talks puts him well to the left of Franklin D Roosevelt

Krauthammer

Krauthammer: 'This is Obama at his most sanctimonious, demagogic, self-righteous and arrogant'

Friday, July 22, 2011

Wednesday, July 20, 2011

The International Monetary Fund...

The IMF's 24 directors "generally agreed that, over the medium term, a stronger renminbi would be an important component in rebalancing the economy toward domestic demand," the fund said in a statement released late yesterday in Washington, using another term for the yuan.

German Chancellor Angela Merkel and French President Nicolas Sarkozy...

Report: Private sector job creation...

...ground to a halt almost instantly after Obamacare passed - Hot Air

Germany, France Reach Accord on Greek Bailout

Germany and France have reached a common position on a second bailout of Greece in their effort to prevent the country's debt crisis from spreading through Europe, officials said on Thursday.

Full Story:

http://www.cnbc.com/id/43832799

The number of Germans fell...

country's total population has managed to remain more or less steady at about 82 million thanks to immigration -- often from countries in Eastern Europe and the Balkans as well as Turkey and Arabic countries

The President's daily Gallup approval rating...

EU May Use Bailout Fund for Emergency Credit

Monday, July 18, 2011

China Chengxin International...

Sunday, July 17, 2011

Saturday, July 16, 2011

Friday, July 15, 2011

Manufacturing flat in June because of weak autos

One year moving average...

Thursday, July 14, 2011

According to Gallup...

European finance ministers...

In the daily Rasmussen...

Wednesday, July 13, 2011

What's Behind the Dismal Jobs Picture

An increase in layoffs may be the culprit behind the weak employment picture, rather than a decrease in hiring.

Full Story:

http://www.cnbc.com/id/43740953

From the Audacity of Hope to Audacity

Now, since realizing that the buck stops on his desk, he is chiding, critical, and

quite pessimistic. ..[sic]...His first order of business in implementing a program of shared sacrifice was to reprimand Democrats and Republicans as though they were behaving like unruly, obstreperous children, in not agreeing to a plan that would put us deeper in debt.

Obama: Unneeded Income Belongs to the Government

President Obama's press conference yesterday-in which he only took questions from left-leaning reporters apparently-contained an amazing statement. It should be noted the first two instances of the first person singular pronoun in the sentence refer to Barack Obama, President of the United States. The second two refer to Barack Obama, taxpaying citizen:

And I do not want, and I will not accept, a deal in which I am asked to do nothing, in fact, I'm able to keep hundreds of thousands of dollars in additional income that I don't need, while a parent out there who is struggling to figure out how to send their kid to college suddenly finds that they've got a couple thousand dollars less in grants or student loans.

There is, of course, nothing whatever stopping Barack Obama, taxpaying citizen, from donating his excess income to the United States Treasury. But his statement demonstrates an astonishing economic illiteracy. To be sure, someone earning a great deal of money has an income greater than what he spends. You can only spend so much on luxurious living however hard you try, a reality so rich with comic possibilities that a 1902 novel called Brewster's Millions has been made into a movie no fewer than nine times.

But, unlike Scrooge McDuck, the rich do not put the excess in a vast money bin and frolic about in it. They invest it. What a concept! Where does Obama think new capital comes from, the tooth fairy? It's nothing more than the excess of income over outgo. Take away the income the rich "don't need" and spend it on social programs, and capital formation in this country drops to zero.

So determined is Obama to deprive "the rich" of excess income-as defined by him, of course-he is even willing to adversely impact government income in order to do so. Read this colloquy between Obama and ABC's Charlie Gibson in a 2008 debate with Hillary Clinton:

MR. GIBSON: And in each instance, when the [capital gains tax] rate dropped, revenues from the tax increased. The government took in more money. And in the 1980s, when the tax was increased to 28 percent, the revenues went down. So why raise it at all, especially given the fact that 100 million people in this country own stock and would be affected?

SENATOR OBAMA: Well, Charlie, what I''ve said is that I would look at raising the capital gains tax for purposes of fairness.

MR. GIBSON: But history shows that when you drop the capital gains tax, the revenues go up.

SENATOR OBAMA: Well, that might happen or it might not. It depends on what''s happening on Wall Street and how business is going.

Actually, it doesn't. Every time capital gains tax rates have gone up, revenues have gone down and vice versa. High capital gains tax rates, because the tax liability is only incurred when an asset is sold, have the effect of locking in capital, which is economically pernicious, preventing capital from flowing to its most productive, i.e wealth creating, use.

Shortly after Obama's election in 2008, I wrote a piece for the Wall Street Journal (irritatingly no longer available on their website, which archives back only two years) saying Obama might not turn out to be the vanguard of the future but rather the last liberal president. I am more confident in that prediction every day.

The Telegraph reports...

There are various reasons for this

including the cost of retirement. However at the other end the number of 18 - 24 year olds working fell over that period from 65.8% to just 58%.

Higher education has delayed people's entry into employment, but the

real reason is the jobs are simply not being created

Great rehearsal

One more and we will be ready

Scott/Harry: I am available this weekend to work on parts again

Only thing I have going on is a 1:20 cub game on Sunday

Jim Geraghty

Mortgage Applications Drop for 4th Week

Applications for U.S. home mortgages fell last week for the fourth week in a row, hurt by a drop in refinance demand even as interest rates tumbled, an industry group said on Wednesday.

Full Story:

http://www.cnbc.com/id/43736739

China Beats Slowdown Fears, Further Tightening Expected

China's economy grew a stronger-than-expected 9.5 percent in the second quarter from a year earlier, retaining much of its momentum and giving Beijing more confidence to tighten monetary policy further to tame stubbornly high inflation.

Full Story:

http://www.cnbc.com/id/43733027